Introduction

The financial markets are known to have become more complex than at any time in history, with the speed at which information collection has already reached today. Investors and traders are badly in need of making decisions as fast as possible and wisely based on a plethora of data flooding their offices to handle. Data analytics refers to “the process of conducting exploratory analyses on large datasets to discover patterns, relationships, and, ultimately, insights” and plays a principal role for these market participants in understanding trends and managing risks while optimizing their investment strategies. The article has focused on the ways analytics from available data can help in financial markets, its diverse applications, benefits, challenges, and future developments.

Understanding Financial Markets

Financial markets are interconnected platforms where different buyers and sellers trade in stocks, bonds, commodities, or currencies. The prices of such markets can fluctuate within blinks or even a few seconds owing to a myriad of factors that include information on economic activities, political actions, or mood changes in the market. For this background, data analytics provides market players with as much meaningful information from the data to act upon it.

What is Data Analytics?

Data analytics can be stated to be data gathered from various sources, processed together, and then analyzed so that conclusions can be drawn. Such an analytization within the financial markets can relate to the historical price data, the volume of trades, economic information, or even sentiments expressed on social media. The idea is essentially just to be able to conclude by extracting useful information that would help in making decisions.

Types of Data Used

Historical Data: Pasts prices, trading volume, and other financial statements

Market Data: Direct from the exchanges information including real-time information regarding current prices of trades.

Alternative Data: Including images from satellites, data provided by the social media, and reviews on the internet as sources aside the conventional ones

Use of Data Analytics in Financial Markets

- Investment Strategies :- There is almost no possibility of establishing effective investment tactics without data analytics. Investors apply historical data to establish trends that are evident and predict future price changes in the market. For example, among the typical approaches employed is the evaluation of previous performance of the stock to determine whether there is a trend for the stock to rise or fall based on historical trends.

- Risk Management :- By nature, financial markets incur risk. With the help of data analytics that defines volatility in markets, state of the economy, and individual asset performance, it is thus possible to determine risks, not only for the investors but also for the institutions. In this way, they are placed in a position to make proper decisions to secure investments.

For instance, the loans portfolio of a bank is analyzed using data analytics and can find out who are the riskiest and avoid such people not to default them. - Market Sentiment Analysis :- Over the last two years, knowledge about the market sentiments has become extremely important. Data analytics can aid the financial analyst to understand the public moods through posts on social media, news articles, and forums online. For example, if people on Twitter are unrealistically optimistic about a particular stock, the price of that particular stock is heading up.

- Algorithmic Trading :- Algorithmic trading refers to orders executed through computer programs over Electronic Communication Networks or directly between firms, or other electronic networks. The algorithm in this process sifts through huge amounts of data from the markets for trading opportunities. To illustrate, it could be an algorithm that identifies some patterns of stock prices and executes the trades once those conditions are met.

This type of trade executes faster and can afford the periodic small discrepancies in price that are missed by human traders. Therefore, it has come to be an essential element of modern trading strategies. - Compliance with Regulation :- Financial institutions must be regulated tightly in preventing fraudulence and to ensure the integrity of market operations. Data analytics allows such institutions to self-regulate as they have transaction tracking, tracing any form of suspicious activity. For example, through data analytics, banks discover money laundering by identifying unusual patterns that exist in transactions.

Benefits Data Analytics Bring to Financial Markets

- Proper Decision Making :- Data analytics helps in better decision making, which is fact-based instead of gut. The investors can decide either to sell or buy assets as it leads to a good outcome for investments.

- Efficiency :- This would translate to greater efficiency in the financial institutions since data collection and analysis would be automated. Financial institutions would then have enough time in order to make strategic decisions instead of remaining stagnant in the routine of having to perform some amount of manual data handling.

- Improved Experience With Customers :- Data analytics, therefore, helps an institution to provide services that cater for the behavior of customers to gain superior satisfaction and loyalty. For example, the banks can develop integral financial products that the individual customers will demand. It will, therefore improve the degree of satisfaction and loyalty as it should be.

- Competitive Advantage :- Actually, data analytics often creates competitive advantages because better insights allow organizations to penetrate and sustain ahead of competitors. Better use of data to spot the various market trends and opportunities allow organizations to seize such trends and opportunities.

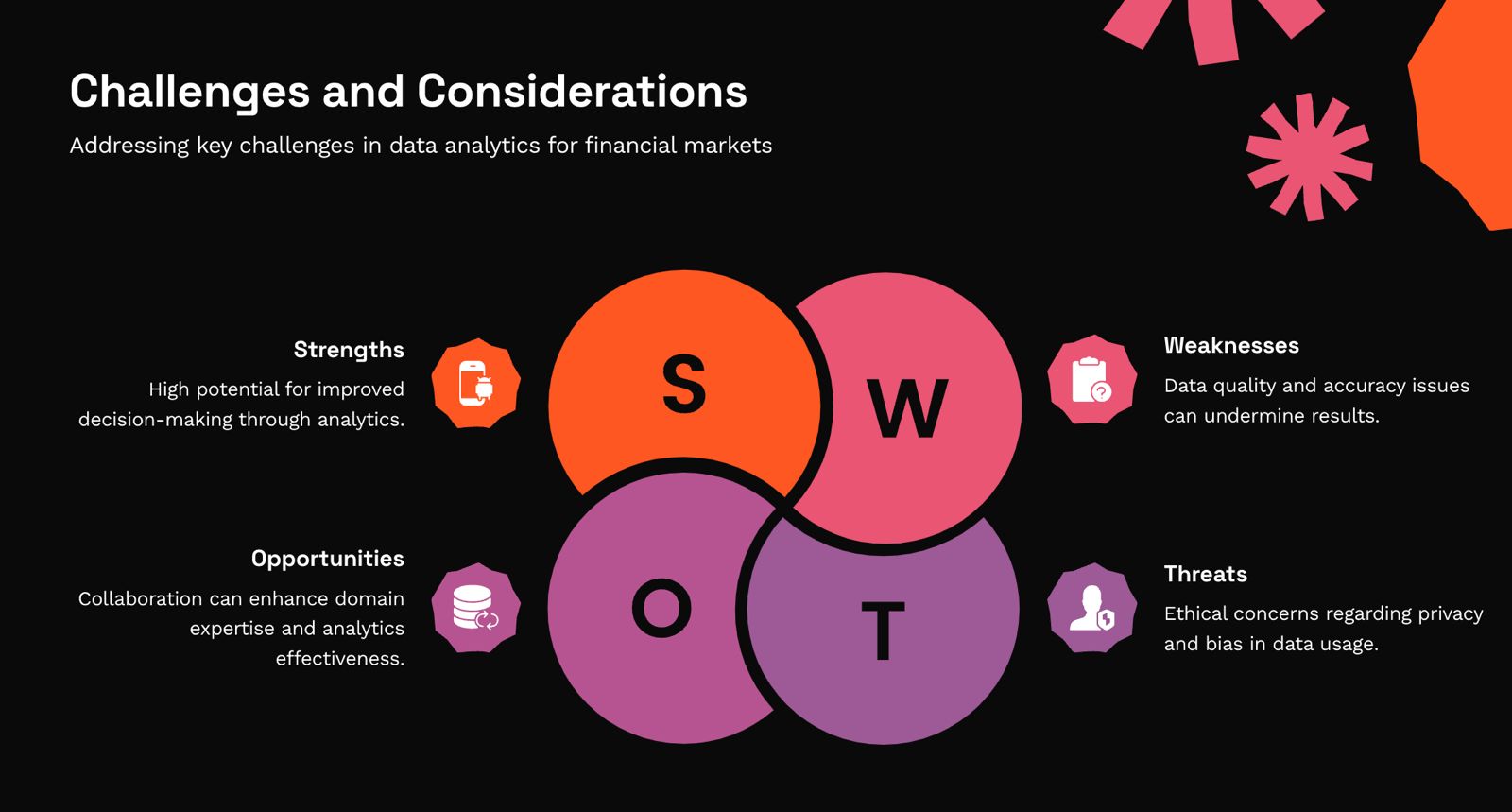

Challenges of Implementing Data Analytics

Although there are quite a number of advantages of data analytics, financial institutions still face several challenges in its implementation .

- Data Quality :- Data analytics largely relies on the quality of the data. In case the data is not very rich or accurate, this may lead to bad decisions after the insights drawn from it. The biggest challenge is in ensuring high-quality data .

- Regulatory Concerns :- It also requires stricter regulations on data privacy and security. Thus, institutions have to act in compliance with the regulations but should use data analytics to the fullest in the process.

- Skills Gap :- Whereas there is a rise in demand for data analytics experts, many organizations face a challenge of sourcing qualified personnel for the positions. As such, it would be grossly applied to the financial markets.

Future Trends of Data Analytics

The aspect of technological development, without a doubt, drives forward the aspect of data analytics. Some future trends that people should look up include the following:

- Artificial Intelligence and Machine Learning :- Increasingly, Artificial Intelligence and Machine Learning are becoming integral applications in data analytics. It can scan voluminous datasets by an accuracy that is very high and identify patterns, which even humans would otherwise miss. For example, it may predict market trends by various variable datasets.

- Real-Time Analytics :- Advanced technology will make real-time analytics the new norm. Financial institutions will know exactly what is going on and then respond with quick informed decisions, thereby more responsively reacting to changes in market conditions.

- Alternative Data Sources :- Alternative sources – social media and satellite imagery – will also continue to forge ahead. This will be powerful in providing unique ways of defining market trends that traditional sources may not.

- Better Data Visualization :- Better data visualization tools will highly rely on the stakeholders to come through. Clear and intuitive visual images can easily contribute towards better decision-making across the industry.

Conclusion

Data analytics is one of the integral parts of modern financial markets. In most ways, it can be said that the benefits relate to how it has upgraded one’s investment strategies and improved one’s risk management, and even lent an insight into market sentiments as well. Of course, challenges like quality of data and regulatory compliance issues persist, but the benefits of using data analytics far outweigh the disadvantages. The prospects for data analytics in finance markets appear promising, as technology is marching forward to ever-higher and more innovative levels, holding much promise for innovations and successes. As such, data analytics is of even interest to high school students with ambitions in finance, being a launching pad into the world of finance.

Author – Agasthya Baid

St George’s College, Mussoorie.